What does the sales tax cut mean for event service providers?

The economic collapse caused by the Corona pandemic has resulted in the tax law being amended twice by the federal government within a short period of time. We'll tell you what the implications are for event service providers.

1. Temporary reduction of the tax rate for the catering industry.

2. Temporary reduction of the tax rate across all industries.

3. What does this mean for the event industry?

4. What will change when submitting offers in the MICE portal?

1. Temporary reduction of the tax rate for the catering industry

For restaurant and catering services provided after 30.6.2020 and before 1.7.2021, with the exception of the supply of beverages, the VAT rate has been reduced from 19% to 7% (Section 12(2) of the VAT Act).

The amendment is intended to mitigate the economic impact of the COVID19 pandemic on the foodservice industry and is therefore temporary. The difference from 19% to 7% = 12% should go to entrepreneurs as liquid assets and revenue/profit. The sales prices were usually fixed before the Corona pandemic and are often also contractually fixed. As a result, the agreed prices remain stable and only the sales tax levy is minimized.

2. Temporary reduction of the tax rate across industries.

In addition to the reduction in the sales tax rate for the hospitality industry, the coalition government decided on June 3, 2020, as part of its economic stimulus and crisis management package, to reduce the sales tax rate from 19% to 16% and from 7% to 5% across all industries from July 1, 2020, to Dec. 31, 2020. This one-time tax cut action is intended to boost domestic consumption.

3. What does this mean for the event industry?

Particularly for companies offering restaurant and catering services, the double two-stage reduction in VAT poses a major challenge: until June 30, 2020, their services will be subject to the 19% VAT rate, then from July 1, 2020, to a reduced VAT rate of 5%, from January 1, 2021, to June 30, 2021, to a reduced VAT rate of 7%, and then (from today's perspective) from July 1, 2021, back to the general VAT rate of 19%.

4. What will change when submitting offers in the MICE portal?

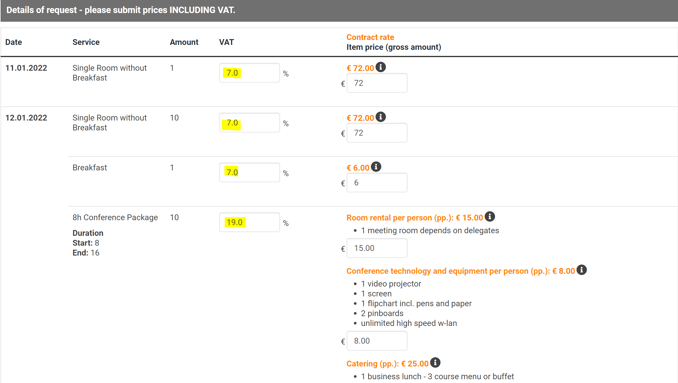

When submitting an offer in the MICE Portal, event service providers can enter the corresponding VAT rate for each offer item in the query field before the price. This way you can easily adjust the sales tax rate according to the legal requirements.

If, when submitting a bid, you are asked to quote a total price for a conference package instead of individual prices for partial services, the tax rate for the services predominantly included in the package will apply. If, for example, the full-day flat rate includes conference drinks, room rental and conference equipment in addition to coffee breaks and lunch, the tax rate of 16% applies.

Please note: The VAT rate is entered without entering a comma, please use the English notation, e.g. 7.0 (dot instead of comma!). Entering values after the dot is allowed e.g. 10.5. Please note that the entered value is not checked, the input field is not subject to validation. The input consists of the number without percent (%) sign.

The decisive factor for the applicable tax rate is the time at which the service is rendered - i.e. the event date. In order to determine the correct VAT rate, it is therefore always necessary to establish when the service was performed.

The receipt of down payments or advance payments is of no significance for the final incurrence of VAT in terms of amount. Particularly in the case of complex and large events, an advance payment is often agreed, even if this has already been made before the change date, this must be corrected with the final invoice. Here, too, only the date of performance counts.

5. What changes in invoicing?

The following also applies to invoicing: the time at which the service is rendered determines the applicable tax rate. The time of invoicing or receipt of payment is irrelevant for the application of the tax rate.

In practice, price agreements between companies are quoted with net prices, so that the change in VAT has no positive or negative effect on the input tax deduction. Only for the service provider, who has to pay less VAT from the effective date, there is an advantage in the amount of 3%.

Please note: All amounts, tax rates, etc. in this article are intended as examples and will not be adjusted according to legal changes or special cases. You can look up current tax rates, for example, at publications of the Federal Ministry of Finance.

Get a head start on trends, new openings, events and news from the industry. With our MICE News you will receive selected and suitable information directly in your mailbox. You can subscribe directly here: https://blog.miceportal.com/